UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| |

| Filed by the Registrant: | x |

|

| |

| Filed by a Party other than the Registrant: | ¨ |

Check the appropriate box:

ox Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

MAIDEN HOLDINGS, LTD.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

| |

| ¨ | Fee paid previously with preliminary materials. |

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No. |

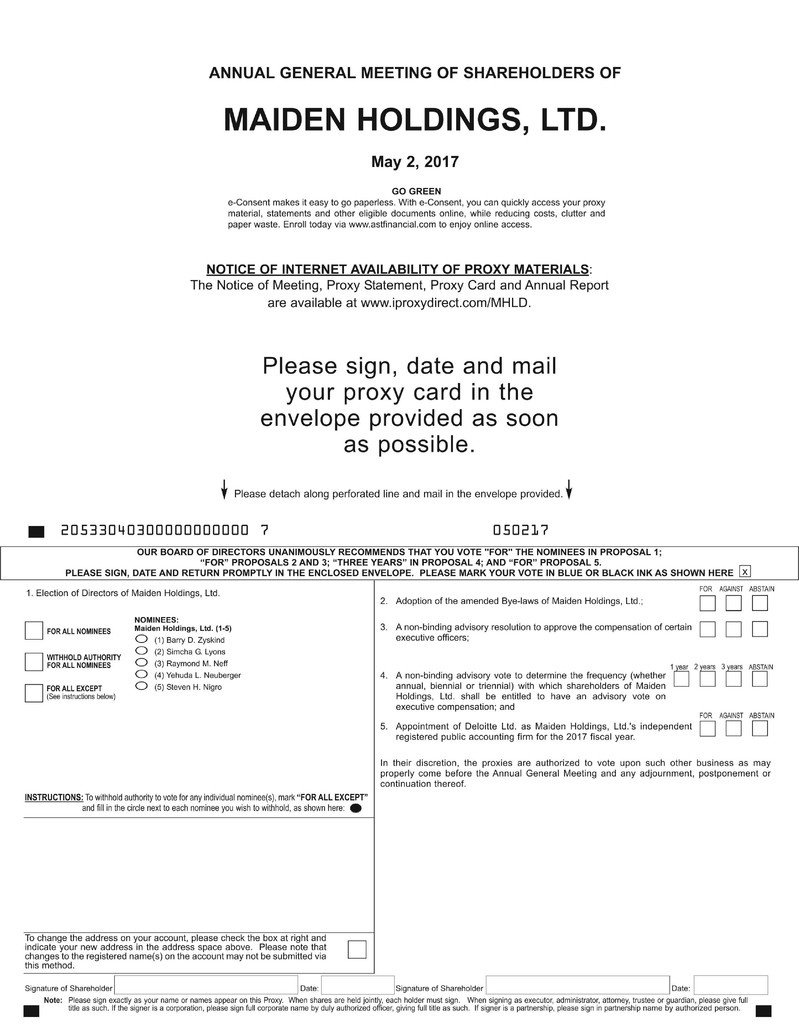

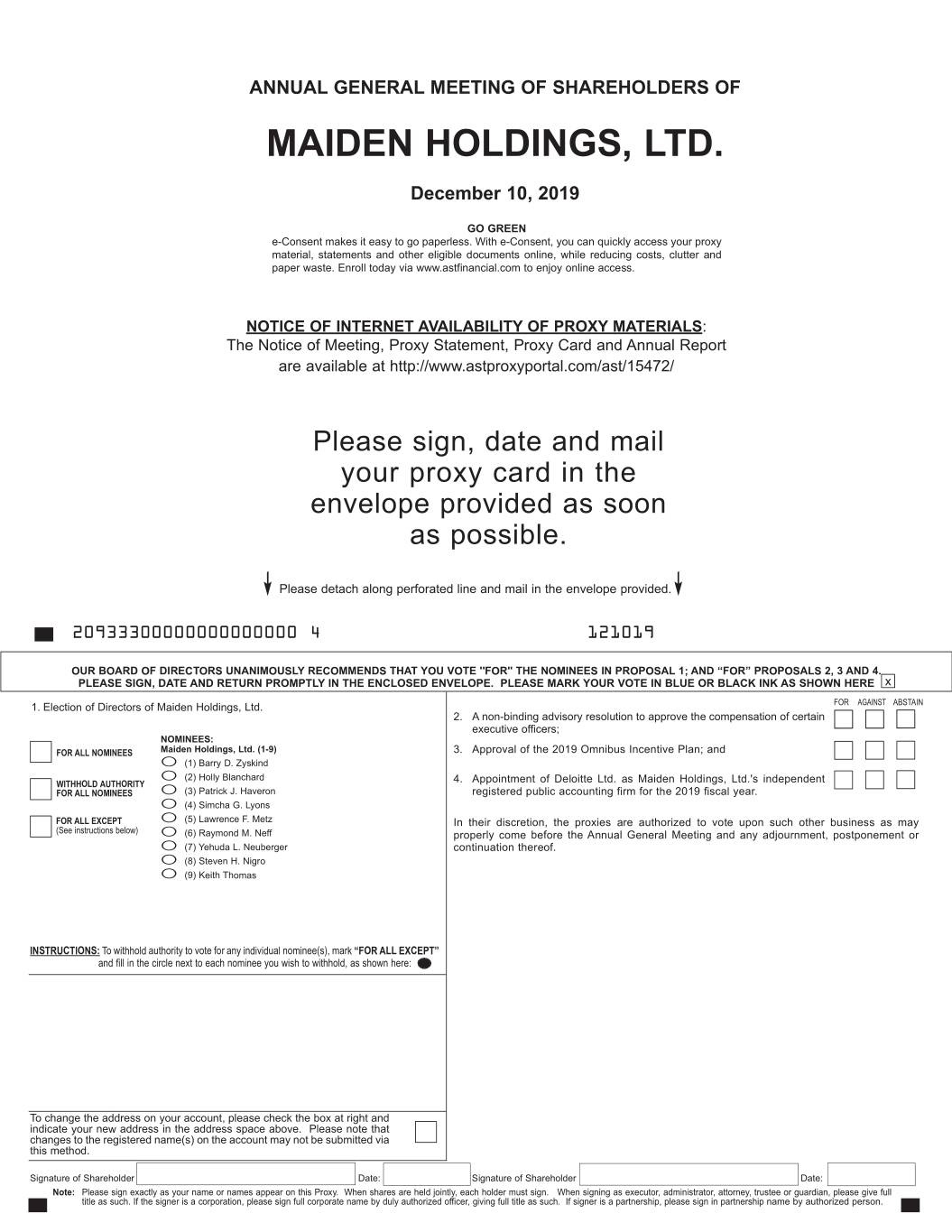

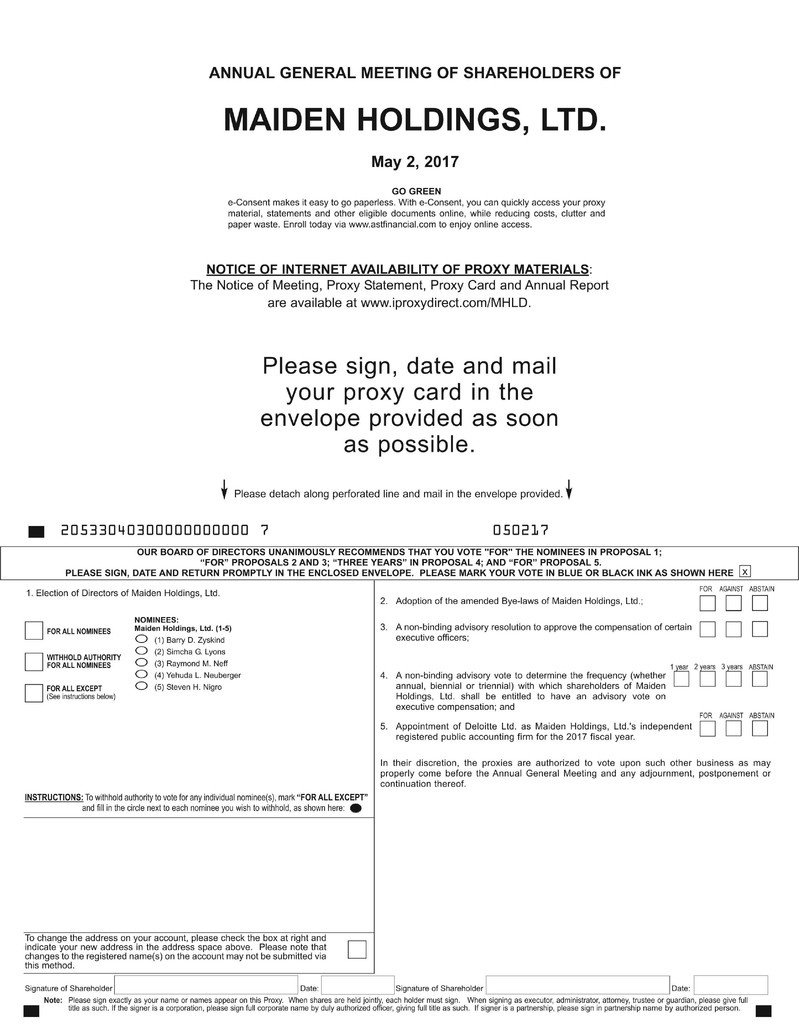

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 2, 2017DECEMBER 10, 2019

Dear Shareholder:

You are cordially invited to attend the 20172019 Annual General Meeting of Shareholders (the “Annual General Meeting” or the “Meeting”) of Maiden Holdings, Ltd. (the “Company”), which will be held on Tuesday, May 2, 2017,December 10, 2019, commencing at 3:2:00 p.m. (local time), at the Company's offices at Maiden House, 131 Front Street,Fairmont Hamilton HM12,Princess, 76 Pitts Bay Road, Pembroke HM08, Bermuda, for the following purposes:

| |

| 1. | The election of the fivenine directors of the Company named in the accompanying Proxy Statement to serve until the 20182020 Annual General Meeting of Shareholders;Meeting; |

| |

| 2. | To adopt the amended Bye-Laws of the Company to reflect the changes described in Appendix I; |

| |

3. | To vote on a non-binding advisory resolution to approve the compensation of certain of our executive officers disclosed in this Proxy Statement; |

| |

4.3. | To vote on a non-binding advisory proposal to determine the frequency (whether annual, biennial or triennial) with which shareholdersApproval of the Company shall be entitled to have an advisory vote on executive compensation; andMaiden Holdings, Ltd. 2019 Omnibus Incentive Plan; |

| |

5.4. | The appointment of Deloitte Ltd. as the Company’s independent registered public accounting firm for the 20172019 fiscal year.year; and |

| |

| 5. | Any other business as may properly come before the meeting. |

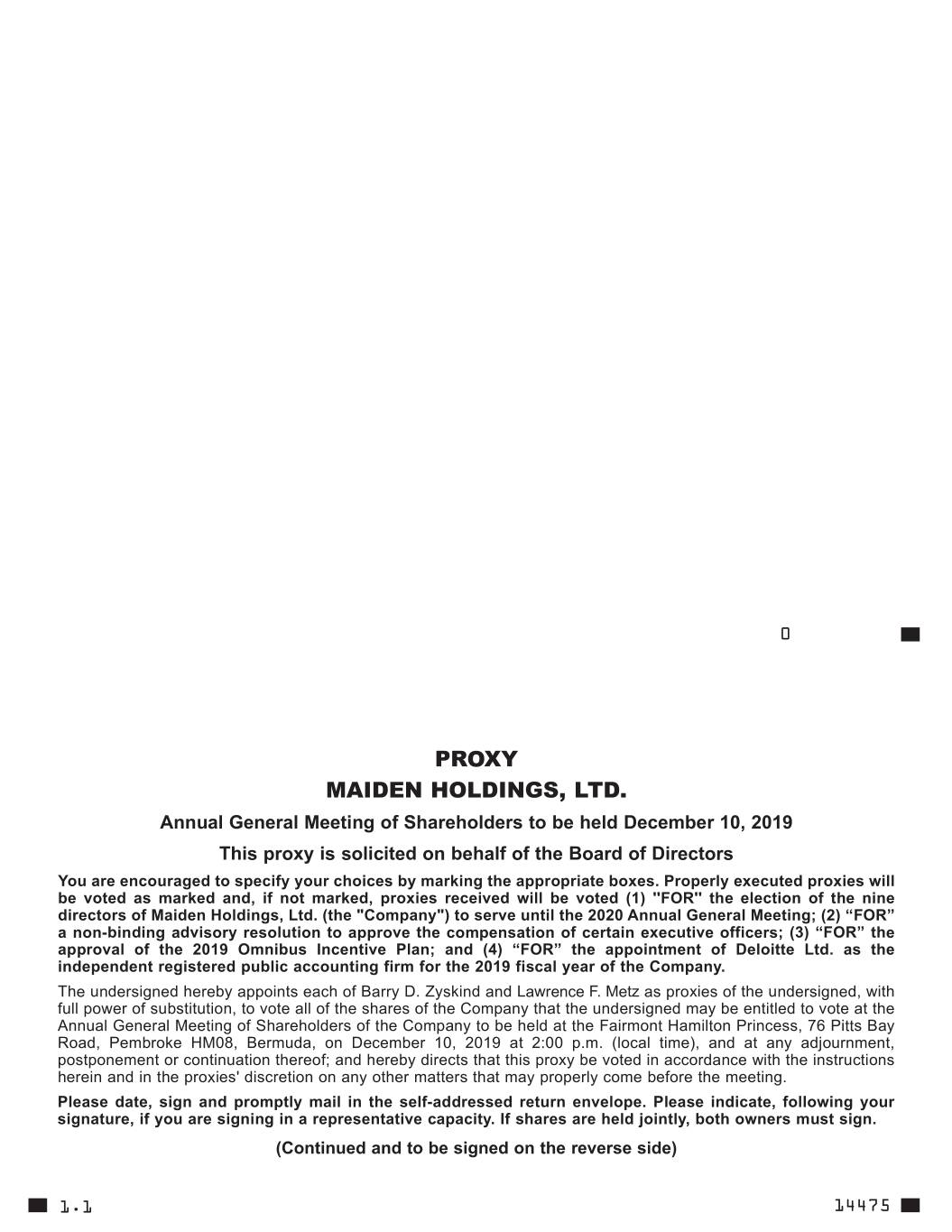

Our Board of Directors unanimously recommends that you vote “FOR” the nominees in Proposal 1; “FOR” Proposals 2 and 3; "THREE YEARS" in Proposal 4; and "FOR" Proposal 5.Proposals 2, 3 and 4.

Holders of record of common shares at the close of business on March 15, 2017,October 18, 2019, the date fixed by our Board of Directors as the record date for the Meeting, are entitled to notice of and to vote on any matters that properly come before the Annual General Meeting and on any adjournment or postponement thereof. Please sign and return your proxy card in the enclosed envelope at your earliest convenience to assure that your shares will be represented and voted at the Meeting even if you cannot attend. On behalf of the officers, directors and employees of the Company, I would like to express our appreciation for your continued support. I look forward to seeing you at the Annual General Meeting.

|

| | |

| | | By Order of the Board of Directors, |

| | | |

| | | Arturo M. RaschbaumLawrence F. Metz

President and Chief Executive Officer |

Hamilton, Bermuda

April 5, 2017November 8, 2019

YOU ARE URGED TO VOTE BY PROMPTLY SIGNING AND RETURNING THE ENCLOSED PROXY IN THE RETURN ENVELOPE PROVIDED TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED. IF YOU ATTEND THE MEETING, YOU MAY, IF YOU DESIRE, REVOKE THE PROXY AND VOTE YOUR SHARES IN PERSON REGARDLESS OF THE METHOD BY WHICH YOU VOTED. YOUR PROXY IS REVOCABLE IN ACCORDANCE WITH THE PROCEDURES SET FORTH IN THIS PROXY STATEMENT.

Important Notice Regarding the Availability of Proxy Materials

for the Annual General Meeting To Be Held on May 2, 2017:December 10, 2019:

The Proxy Statement and Annual Report to security holders are available at www.iproxydirect.com/MHLDwww.astproxyportal.com/ast/15472

PROXY STATEMENT

General Information

This Proxy Statement and the accompanying form of proxy are furnished to you and other shareholders of Maiden Holdings, Ltd. (“Maiden Holdings,” “Company,” “our,” “us,” or “we”) on behalf of our board of directors (the “Board of Directors”) for use at the 20172019 Annual General Meeting of Shareholders (the “Annual General Meeting” or the “Meeting”) to be held at the Company's offices, Maiden House, 131 Front Street,Fairmont Hamilton HM12,Princess, 76 Pitts Bay Road, Pembroke HM08, Bermuda, on Tuesday, May 2, 2017,December 10, 2019, at 3:2:00 p.m. (local time) and any adjournment or postponement thereof. All shareholders are entitled and encouraged to attend the Annual General Meeting in person.

All expenses in connection with this solicitation of proxies will be paid by us. Proxies will be solicited principally by mail, but directors, officers and certain other individuals authorized by us may personally solicit proxies. We will reimburse custodians, nominees or other persons for their out-of-pocket expenses in sending proxy material to beneficial owners.

This Proxy Statement, together with the accompanying proxy card, was first mailed to shareholders entitled to vote at the Annual General Meeting on or about April 5, 2017.November 8, 2019.

Matters to Be Voted Upon

As of March 15, 2017,October 18, 2019, the only business we expect to be presented at the Annual General Meeting is:

| |

| 1. | Election of the fivenine directors of Maiden Holdings named in the accompanying Proxy Statement to serve until the 20182020 Annual General Meeting of Shareholders; |

| |

| 2. | To adopt the amended Bye-Laws of the Company to reflect the changes described in Appendix I; |

| |

3. | To vote on a non-binding advisory resolution to approve the compensation of certain of our executive officers disclosed in this Proxy Statement; |

| |

4.3. | To vote on a non-binding advisory proposal to determineapprove the frequency (whether annual, biennial, or triennial) with which shareholders of the Company shall be entitled to have an advisory vote on executive compensation; andMaiden Holdings, Ltd. 2019 Omnibus Incentive Plan; |

| |

5.4. | The appointment of Deloitte Ltd. as the Company’s independent registered public accounting firm for the 20172019 fiscal year.year; and |

| |

| 5. | Any other business that may be properly brought before the meeting. |

Record Date

The Board has fixed the close of business on March 15, 2017October 18, 2019 as the record date for determining the holders of common shares entitled to notice of and to vote at the Annual General Meeting.

Outstanding Voting Securities

As of the record date, there were 86,548,52984,146,612 outstanding common shares entitled to one vote per share.

Voting

Only holders of record of common shares at the close of business on March 15, 2017October 18, 2019 are entitled to vote at the Annual General Meeting or at any adjournment or postponement of the Meeting. Each common share that you own entitles you to one vote.

If I am a shareholder of record of common shares, how do I vote?

If you are a shareholder of record, you may vote by mailing a completed proxy card. To vote by mailing a proxy card, please sign and return the enclosed proxy card in the enclosed prepaid and self-addressed envelope and your shares will be voted at the Annual General Meeting in the manner you directed. You may also vote your shares in person at the Annual General Meeting. If you are a shareholder of record, you may request a ballot at the Annual General Meeting.

If I am a beneficial owner of shares held in street name, how do I vote?

If you are the beneficial owner of shares held in street name, you will receive instructions from your bank or broker that must be followed for such bank or broker to vote your shares per your instructions. Your bank or broker will not have discretion to vote uninstructed shares on Proposals 1, 2 3 and 4.3. Thus, if you hold your shares in street name and do not instruct your bank or broker how to vote on Proposals 1, 2 3 and 4,3, no votes will be cast on your behalf with respect to such matter (a “broker non-vote”). Your bank or broker will, however, have discretion to vote uninstructed shares on the appointment of Deloitte Ltd. as the Company’s independent registered public accounting firm for the 20172019 fiscal year. Please ensure that you complete the voting instruction card sent by your bank or broker. If your shares are held in street name and you wish to vote in person at the Annual General Meeting, you must obtain a proxy issued in your name from your bank or broker and bring it with you to the Meeting. We recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual General Meeting.

May I change my vote?

All proxies delivered pursuant to this solicitation are revocable at any time before they are exercised at the option of the persons submitting them by giving written notice to the Corporate Secretary, Maiden Holdings, Ltd., MaidenIdeation House, 131 Front Street, Hamilton HM12,2nd Floor, 94 Pitts Bay Road, Pembroke HM08, Bermuda, by submitting a later-dated proxy by mail or by voting in person at the Annual General Meeting. If your shares are held in a brokerage account, you must make arrangements with your broker or bank to revoke your proxy.

What constitutes a quorum?

Two or more persons present in person or representing in person or by proxy in excess of 50% of the total issued voting shares of the Company will constitute a quorum for the transaction of business at the Annual General Meeting. Shareholder abstentions and broker non-votes will be included in the number of shareholders present at the Annual General Meeting for the purpose of determining the presence of a quorum.

What if a quorum is not represented at the Annual General Meeting?

If within 30 minutes from the time appointed for the Meeting a quorum is not present, the Meeting shall stand adjourned to the same day one week later, at the same time and place or to such other day, time or place as the Corporate Secretary may determine. Unless the Meeting is adjourned to a specific date, place and time announced at the Meeting being adjourned, fresh notice of the date, place and time for the resumption of the adjourned Meeting shall be given to each shareholder entitled to attend and vote thereat.

How many votes are required to approve a proposal?

Under our bye-laws, any question proposed for the consideration of the shareholders at any general meeting shall be decided by the affirmative votes of a majority of the votes cast “For” or “Against” the proposal by the holders of the common shares of the Company.

How will my shares be voted and how are votes counted?

All common shares represented by properly executed proxies received pursuant to this solicitation will be voted in accordance with the shareholder’s directions specified on the proxy.

Election of directors

In voting by proxy with regard to the election of directors, shareholders may vote in favor of each nominee or withhold their votes as to each nominee. Should any nominee become unable to accept nomination or election, the proxy holders named in the proxy card will vote for the election of such other person as a director as the present directors may recommend in the place of such nominee. Abstentions and broker non-votes will have no effect on the election of directors.

Amendment to Bye-laws

The affirmative vote of at least a majority of the shares represented and voting at the Meeting at which a quorum is present, which shares voting affirmatively also constitute at least a majority of the required quorum, is necessary for the amendment of our Bye-laws.

Advisory Vote on Executive Compensation

The number of affirmative votes validly cast in favor of the proposal to approve the compensation of our named executive officers must exceed the number of votes cast against the proposal in order to approve, on an advisory basis, the proposal, although such vote will not be binding on us. Abstentions and broker non-votes will have no effect on this proposal.

Advisory Vote on the FrequencyApproval of the Advisory Vote on Executive CompensationMaiden Holdings, Ltd., 2019 Omnibus Incentive Plan

You may vote to approve, on an advisory basis, the frequencyThe number of the advisory vote on the compensation of our named executive officers every one, two or three years, or you may abstain from voting. The frequency of holding the advisory vote on the compensation of our named executive officers will be decided by a plurality of theaffirmative votes validly cast although such vote will not be binding on us.in favor of the proposal to approve the Maiden Holdings, Ltd. Omnibus Incentive Plan (the “2019 Plan”) must exceed the number of votes cast against the proposal in order to approve the 2019 Plan. Abstentions and broker non-votes will have no effect on this proposal.

Ratification of Auditors

With regard to the ratification of the appointment of the independent auditors, shareholders may vote in favor of the proposal, may vote against the proposal or may abstain from voting.

Shareholders should specify their choices on the enclosed proxy card. If no directions have been specified by marking the appropriate squares on the accompanying proxy card, the shares represented by a properly submitted proxy will be voted:

| |

| 1. | “FOR” the election of the fivenine directors of Maiden Holdings to serve until the 20182020 Annual General Meeting; |

| |

| 2. | “FOR” the amendment to the Bye-Laws of the Company to reflect the changes described in Appendix I of this Proxy Statement; |

| |

3. | “FOR”"FOR" the approval, on an advisory basis, of executive compensation; |

| |

4.3. | “THREE YEARS” in a non-binding advisory vote to determineFOR” the frequency (whether annual, biennial or triennial)approval of an advisory vote on executive compensation;the Maiden Holdings, Ltd. 2019 Omnibus Incentive Plan; and |

| |

5.4. | “FOR” the appointment of Deloitte Ltd. as the Company’s independent registered public accounting firm for the 20172019 fiscal year. |

In connection with any other business that may properly come before the Annual General Meeting, all properly executed proxies delivered pursuant to this solicitation and not revoked will be voted for you in the discretion of the proxy holders named in the proxy card.

A shareholder signing and returning the accompanying proxy has the power to revoke it at any time prior to its exercise by giving written notice of revocation to our Corporate Secretary, by submitting a proxy bearing a later date, or by attending the Annual General Meeting and voting in person. Attendance at the Annual General Meeting will not constitute, in itself, revocation of a proxy. If your shares are held in a brokerage account, you must make arrangements with your broker or bank to revoke your proxy.

May I see a list of shareholders entitled to vote as of the record date?

A list of registered shareholders as of the close of business on March 15, 2017October 18, 2019 will be available for examination by any shareholder during normal business hours through May 1, 2017,December 9, 2019, at the principal executive offices of the Company, at MaidenIdeation House, 131 Front Street, Hamilton HM12,2nd Floor, 94 Pitts Bay Road, Pembroke HM08, Bermuda.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information with respect to the beneficial ownership of our common shares by each person or group known by us to own more than 5% of our common shares. Ownership percentages are based on 86,548,52984,146,612 common shares outstanding as of March 15, 2017.October 18, 2019. We refer to Barry Zyskind, Michael Karfunkel and George Karfunkel as our “Founding Shareholders” in this Proxy Statement. Michael Karfunkel passed away on April 27, 2016.

|

| | | | | | |

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class |

Barry D. Zyskind, c/o Maiden Holdings, Ltd. 131 Front Street, Hamilton HM12, Bermuda | | 6,469,292 |

| (1) | 7.5 | % |

Leah Karfunkel c/o Maiden Holdings, Ltd.

131 Front Street, Hamilton HM12, Bermuda | | 6,792,600 |

| (2) | 7.8 | % |

Boston Partners One Beacon Street, Boston, MA 02108 | | 4,528,428 |

| (3) | 5.2 | % |

Dimensional Fund Advisors LP Building One, 6300 Bee Cave Road, Austin, TX 78746 | | 6,295,515 |

| (4) | 7.3 | % |

The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | | 6,745,206 |

| (5) | 7.8 | % |

BlackRock Inc. 55 East 52nd Street, New York, NY 10055 | | 8,045,018 |

| (6) | 9.3 | % |

|

| | | | | | |

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class |

Barry D. Zyskind, c/o Maiden Holdings, Ltd. Ideation House, 2nd Floor, 94 Pitts Bay Road, Pembroke HM08, Bermuda | | 6,374,292 |

| (1) | 7.6 | % |

Leah Karfunkel c/o Maiden Holdings, Ltd.

Ideation House, 2nd Floor, 94 Pitts Bay Road, Pembroke HM08, Bermuda | | 6,792,600 |

| (2) | 8.1 | % |

683 Capital Partners, LP 3 Columbus Circle, Suite 2205, New York, NY 10019 | | 7,876,964 |

| (3) | 9.4 | % |

Dimensional Fund Advisors LP Building One, 6300 Bee Cave Road, Austin, TX 78746 | | 6,588,465 |

| (4) | 7.8 | % |

Catalina Holdings (Bermuda) Ltd. Cumberland House, 1 Victoria Street, 7th Floor, Hamilton HM11, Bermuda | | 6,643,981 |

| (5) | 7.9 | % |

Talkot Capital, LLC 30 Liberty Ship Way, Suite 3110, Sausalito, CA 94965 | | 6,429,829 |

| (6) | 7.6 | % |

| |

| (1) | Based on Amendment No. 23 to Schedule 13D filed with the SEC on June 23, 2016, Mr. Zyskind disclaims beneficial ownership ofApril 4, 2019, and Form 4 filed with the 95,000 common shares that he holds indirectly as a trustee of the Teferes Foundation, a charitable foundation organized by Mr. Zyskind.SEC on March 31, 2017. Mr. Zyskind holds 220,000 of these common shares as a custodian for his children under the Uniform Transfers to Minors Act. |

| |

| (2) | Based on Amendment No. 6 to Schedule 13D of Leah Karfunkel filed with the SEC on June 23, 2016, Leah Karfunkel beneficially owns 5,500,470 common shares held indirectly as a trustee of the Michael Karfunkel 2005 Family Trust. Leah Karfunkel is the wife of Michael Karfunkel. Leah Karfunkel disclaims beneficial ownership of these shares held by the HOD Foundation, a charitable foundation. |

| |

| (3) | Based on Amendment No. 61 to Schedule 13G13D filed with the SEC on February 14, 2017.June 28, 2019; 683 Capital Partners, LP (“683 Capital”) jointly filed with three other Reporting Persons: 683 Capital GP, LLC (“683 GP” the General Partner of 683 Capital), 683 Capital Management, LLC (“683 Management” the investment manager of 683 GP) and Ari Zweiman, the managing member of 683 GP and 683 Management. |

| |

| (4) | Based on Amendment No. 25 to Schedule 13G filed with the SEC on February 9, 2017.8, 2019. |

| |

| (5) | Based on Amendment No. 1 to Schedule 13G13D filed with the SEC on February 10, 2017.September 14, 2018. |

| |

| (6) | Based on Amendment No. 2 to Schedule 13G13D filed with the SEC on January 30, 2017.June 10, 2019; Talkot Capital, LLC, as investment adviser, filed on behalf of three other Reporting Persons: Talkot Fund, L.P., Talkot Capital, LLC 401(k) PSP and Thomas B. Akin. |

SECURITY OWNERSHIP OF MANAGEMENT

Set forth below is information concerning the beneficial ownership of our common shares by each director, by our executive officers named in the Summary Compensation Table below and by all our directors and executive officers as a group as of March 15, 2017.October 18, 2019. For purposes of the table below, commonthe amounts and percentage of shares subjectbeneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. Also, options which are currently exercisable or exercisable within 60 days of March 15, 2017October 18, 2019 are considered outstanding and beneficially owned by the person holding the options for the purposes of computing beneficial ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| | | Name of Beneficial Owner** | | Amount & Nature of Beneficial Ownership | | Percent of Class(1) | | Amount & Nature of Beneficial Ownership | | Percent of Class(1) |

| Barry D. Zyskind | | 6,469,292 |

| (2) | 7.5% | | 6,374,292 |

| (2) | 7.6% |

| Arturo M. Raschbaum | | 1,339,197 |

| (3) | 1.5% | |

| Karen L. Schmitt | | 321,973 |

| (4) | * | |

| Patrick J. Haveron | | 124,190 |

| (5) | * | |

| Thomas H. Highet | | 37,251 |

| (6) | * | |

| Lawrence F. Metz | | 77,105 |

| (7) | * | |

| Simcha G. Lyons | | 66,505 |

| (8) | * | | 82,505 |

| (3) | * |

| Raymond M. Neff | | 210,000 |

| (9) | * | | 420,500 |

| (4) | * |

| Yehuda L. Neuberger | | 125,000 |

| (10) | * | | 319,000 |

| (5) | * |

| Steven H. Nigro | | 13,000 |

| (11) | * | | 54,000 |

| (6) | * |

| All executive officers and directors as a group (10 persons) | | 8,783,513 |

| | 10.0% | |

| Lawrence F. Metz | | | 548,819 |

| (7) | * |

| Patrick J. Haveron | | | 750,072 |

| (8) | * |

| William T. Jarman | | | 37,028 |

| (9) | * |

| Denis M. Butkovic | | | 19,748 |

| (10) | * |

| Michael C. Haines | | | 15,873 |

| (11) | * |

| Arturo M. Raschbaum | | | 433,171 |

| (12) | * |

| Karen L. Schmitt | | | 323,748 |

| (13) | * |

| Thomas H. Highet | | | 47,799 |

| (14) | * |

| All executive officers and directors as a group (13 persons) | | | 9,426,555 |

| | 11.2% |

| |

| ** | The address of each beneficial owner listed in the table is c/o Maiden Holdings, Ltd., 131 Front Street, Hamilton HM12,Ideation House, 2nd Floor, 94 Pitts Bay Road, Pembroke HM08, Bermuda. |

| |

| (1) | Based on 86,548,52984,146,612 common shares outstanding at March 15, 2017October 18, 2019 plus shares that the beneficial owner has the right to acquire within 60 days of March 15, 2017October 18, 2019 upon exercise of share options. |

| |

| (2) | Includes 95,000 shares held by Teferes Foundation, a charitable foundation organized by Mr. Zyskind. Mr. Zyskind does not have a beneficial interest in the shares held by Teferes Foundation, and therefore disclaims beneficial ownership of these common shares. Mr. Zyskind holds 220,000 of these common shares as a custodian for his children under the Uniform Transfers to Minors Act. |

| |

| (3) | The amount shown above includes vested options to acquire 896,18024,000 common shares granted on November 12, 2008, November 12, 2009June 1, 2013, June 1, 2014, June 1, 2015 and November 12, 2010. It does not include 46,928 restricted share units which vest into common shares in February 2018 and 25,330 restricted share units which vest into common shares in February 2019.June 1, 2016. |

| |

| (4) | The amount shown above includes vested options to acquire 82,20042,000 common shares granted on February 24, 2009June 1, 2010, June 1, 2011, June 1, 2012, June 1, 2013, June 1, 2014, June 1, 2015 and March 4, 2010. Also includes 5,064 restricted shares issued on February 17, 2015, which will vest on February 17, 2018.June 1, 2016. |

| |

| (5) | The amount shown above includes vested options to acquire 42,000 common shares granted on June 1, 2010, June 1, 2011, June 1, 2012, June 1, 2013, June 1, 2014 June 1, 2015 and June 1, 2016. |

| |

| (6) | The amount shown above includes vested options to acquire 18,000 common shares granted on June 1, 2014, June 1, 2015 and June 1, 2016. |

| |

| (7) | The amount shown above includes vested options to acquire 50,000 common shares granted to Mr. Metz on March 4, 2010. It also includes 90,090 restricted shares vesting 50% annually on the anniversary of the grant date into common shares on August 8, 2020 and August 8, 2021, respectively, and includes 316,904 restricted shares vesting 50% on March 20, 2020 and 50% on March 20, 2021, which Mr. Metz has the ability to vote, but is restricted from transferring until their respective vesting dates. |

| |

| (8) | The amount shown above includes vested options to acquire 30,000 common shares granted to Mr. Haveron on March 4, 2010. AlsoIt also includes 3,163111,836 restricted shares issuedvesting one third annually on February 17, 2015, which will vest on February 17, 2018. |

| |

(6) | The amount shown above includes vested options to acquire 938 common shares granted on March 4, 2010. |

| |

(7) | The amount shown above includes vested options to acquire 58,000 common shares granted on June 1, 2009 and March 4, 2010. |

| |

(8) | The amount shown above includes vested options to acquire 30,000 common shares granted on June 26, 2007, June 1, 2013, June 1, 2014 and June 1, 2015. Excludes an option to acquire 6,000 common shares granted on June 1, 2016, which options will vest on the first anniversary of the grant date of grant.into common shares on November 6, 2019, November 6, 2020 and November 6, 2021, respectively, and includes 475,356 restricted shares vesting 50% on March 20, 2020 and 50% on March 20, 2021, which Mr. Haveron has the ability to vote, but is restricted from transferring until their respective vesting dates. |

| |

| (9) | The amount shown above includes vested options to acquire 60,0007,500 common shares granted to Mr. Jarman on June 26, 2007, June 26, 2008, June 1, 2009, June 1, 2010, June 1, 2011, June 1, 2012, June 1, 2013, June 1, 2014 and June 1, 2015. Excludes an option to acquire 6,000 common shares granted on June 1, 2016, which options will vest on the first anniversary of the date of grant.February 22, 2012. |

| |

| (10) | The amount shown above includes vested options to acquire 60,0001,875 common shares granted to Mr. Butkovic on January 8, 2008, June 26, 2008, June 1, 2009, June 1, 2010, June 1, 2011, June 1, 2012, June 1, 2013, June 1, 2014 and June 1, 2015. Excludes an option to acquire 6,000 commonOctober 11, 2018. It also includes 15,873 restricted shares granted on June 1, 2016, which options will vestvesting one third annually on the first anniversary of the grant date of grant.into common shares on January 16, 2020, January 16, 2021 and January 16, 2022, respectively, which Mr. Butkovic has the ability to vote, but is restricted from transferring until their respective vesting dates. |

| |

| (11) | The amount shown above includes 15,873 restricted shares granted to Mr. Haines vesting one third annually on the anniversary of the grant date into common shares on January 16, 2020, January 16, 2021 and January 16, 2022, respectively, which Mr. Haines has the ability to vote, but is restricted from transferring until their respective vesting dates. |

| |

| (12) | Mr. Raschbaum is no longer a named executive officer of the Company and no longer makes public filings regarding his common share holdings of the Company, thus this is based on the most recent public filings. Mr. Raschbaum retired from his position as President and Chief Executive Officer on September 1, 2018. On September 30, 2018, Mr. Raschbaum signed a separation agreement with Maiden Holdings, Ltd, in which he agreed to forfeit any of his remaining outstanding equity in exchange for a release payment of $2,200,000 which he received in 2018. He forfeited vested share options of 896,180 granted on November 12, 2008, November 12, 2009 and November 12, 2010 and 25,330 restricted share units scheduled to vest into common shares in February 2019. |

| |

| (13) | Ms. Schmitt is no longer a named executive officer of the Company and no longer makes public filings regarding her common share holdings of the Company, thus this is based on the most recent public filings. The amount shown above includes vested options to acquire 12,00050,000 common shares granted March 4, 2010. As part of a signed separation agreement with Maiden Holdings, Ltd., Ms. Schmitt agreed to forfeit her remaining unvested performance restricted share units which totaled 107,086 in exchange for a release payment of $2,000,000 on June 1, 2014August 31, 2018 and June 1, 2015. Excludes an option to acquire 6,000$1,325,000 in March 2019. |

| |

| (14) | Mr. Highet is no longer a named executive officer of the Company and no longer makes public filings regarding his common shares granted on June 1, 2016, which options will vestshare holdings of the Company thus this is based on the first anniversarymost recent public filings. Mr. Highet resigned from the Company on August 29, 2018 upon completion of the date of grant.renewal rights transaction with TransAtlantic Re. |

PROPOSAL 1:

ELECTION OF DIRECTORS

Our Board of Directors currently consists of five directors. These five current directors plus an additional four newly nominated directors will be elected at the Annual General Meeting, each to serve for a one-year term until the 20182020 Annual General Meeting of Shareholders and until the election or appointment and qualification of his or her successor, or until his or her earlier death, resignation or removal. Upon recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has unanimously nominated Messrs.Mr. Barry D. Zyskind, Ms. Holly Blanchard and Messrs. Patrick J. Haveron, Simcha G. Lyons, Lawrence F. Metz, Raymond M. Neff, Yehuda L. Neuberger, and Steven H. Nigro and Keith A. Thomas for election as directors at the Annual General Meeting. Proxies cannot be voted for more than fivenine director nominees.

Each of the five director nominees is standing for re-election to the Board of Directors and haseach of the four new director nominees have consented to serve for a newthe next term. Unless you otherwise indicate, proxies that we receive will be voted in favor of the election of the director nominees. The Board of Directors does not contemplate that any of the nominees will be unable to stand for election, but if any nominee becomes unable to serve or for good cause will not serve, all proxies (except proxies marked to the contrary) will be voted for the election of a substitute nominee as our Board of Directors may recommend.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES BELOW.

Information About the Nominees

Barry D. Zyskind, 45,47, has served as non-executive Chairman of our Board of Directors since June 2007 and is a Founding Shareholder of the Company. Since 1998, Mr. Zyskind has served as the President, Chief Executive Officer and Chairmandirector of AmTrust Financial Services, Inc. (“AmTrust”), a publicly-traded multinational property and casualty insurer specializing in commercial lines coverage for small to mid-size businesses. Mr. Zyskind is also a director of several of AmTrust's wholly owned subsidiaries.businesses, and Chairman since 2016. Prior to joining AmTrust, Mr. Zyskind was an investment banker at Janney Montgomery Scott LLC in New York. Mr. Zyskind holds an M.B.A. from New York University's Stern School of Business. Mr. Zyskind is the son-in-law of Leah Karfunkel, who is a major shareholder of the Company and serves on the board of directors of AmTrust and National General Holding Corporation (“NGHC”), a holding company of the former GMAC Insurance personal lines companies. Mr. Zyskind has been a director of NGHC since 2013 and its non-executive chairman of the board of directors since the death of Michael Karfunkel in 2016.2013.

In selecting Mr. Zyskind as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Zyskind's outside board service and business activities, including his significant executive experience in international business operations, his finance, strategic planning and information technology expertise and his knowledge of the insurance industry.

Holly Blanchard, 44, is the President and Managing Member of Regulatory Insurance Advisors, LLC, a consulting firm specializing in insurance regulatory matters and enterprise risk management that she formed in January 2016. Ms. Blanchard has over 20 years of insurance experience including extensive market conduct, Affordable Care Act ("ACA"), and regulatory expertise. Ms. Blanchard previously served as Life and Health Administrator for the Nebraska Department of Insurance ("Department") overseeing the Department’s product and rate operations, including the Department’s implementation of the ACA. Ms. Blanchard also served as the Department’s Market Conduct Examiner in Charge. Ms. Blanchard holds a B.S. in Speech Pathology from the University of Nebraska-Lincoln and a B.A. in Business Administration from Nebraska Wesleyan University. Ms. Blanchard holds several industry designations, is a Past-President and current member of the Board of Directors for the Insurance Regulatory Examiners Society, and a past Board of Directors member for the Association of Insurance Compliance Professionals. Ms. Blanchard also serves on the Board of Directors and Audit Committee for American Life and Securities Corp. and is on the Leadership Counsel for the National Small Business Association. Ms. Blanchard also is active in multiple committees and sub-committees of the National Association of Insurance Commissioners and she presents at National Trade Organization conferences frequently as a subject matter expert in varied insurance topics.

In selecting Ms. Blanchard as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Ms. Blanchard's extensive insurance regulatory experience and expertise as well as her outside board service and business activities.

Patrick J. Haveron, 58, has served as Executive Vice President, Chief Financial Officer and Chief Operating Officer of the Company since September 2018, and has served as President of our wholly owned subsidiary Maiden Reinsurance Ltd. since February 2014. Mr. Haveron has served as Executive Vice President since November 2009. Mr. Haveron is also a director of several of our wholly owned subsidiaries. From 2004 to 2009, Mr. Haveron was President and Chief Executive Officer of Preserver Group, Inc., a publicly-traded property and casualty insurer, after having served in a variety of financial and executive leadership roles since 1988. Mr. Haveron was also Senior Vice President and Chief Operating Officer of Tower Group, Inc., a publicly-traded property and casualty insurer, from 2007 to 2009 after its acquisition of Preserver in 2007. Mr. Haveron has previously served on the board of governors of the Property Casualty Insurers Association of America, and holds a B.S. from the University of Scranton.

In selecting Mr. Haveron as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Haveron’s leadership role as the Company’s chief financial and operating officer, his being a significant stakeholder developing and implementing the forward strategy and success of the Company, and his past directorship experience in both public and private companies in our industry.

Simcha G. Lyons, 70,72, has been a member of our Board of Directors since June 2007, and he currently serves as Chairman of the Nominating and Corporate Governance Committee and as a member of the Audit Committee and the Compensation Committee. Since 2005, Mr. Lyons has served as a senior advisor to the Ashcroft Group, LLC of Washington, D.C., a strategic consulting firm that was founded by the former Attorney General of the United States, John Ashcroft. Mr. Lyons also serves as a Senior Advisor to the Ashcroft Law Firm and as a Senior Advisor to Banner Public Affairs, a political lobbying/consulting company in Washington DC. In 2017, Mr. Lyons was appointed to the Board of Directors of Better Air Ltd., an Australian biotechnology company, and to BSD Growth Fund PCC Limited, a Gibraltar Experienced Investor Fund. Mr. Lyons previously served by appointment of the President of the United States on the United States Holocaust Memorial Council. In addition, Mr. Lyons has been the chairman of Lyons Global Insurance Services, LLC since 2009. Since 2003, he has also served as chairman of Lyons Global Advisors Ltd., a political consulting firm. Prior to 2002, Mr. Lyons was Vice-Chairman of Raskas Foods of St. Louis, Missouri.

In selecting Mr. Lyons as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Lyons' outside business activities, including his extensive understanding of governmental and legal affairs and significant executive and finance experience.

Lawrence F. Metz, 46, has served as President and Chief Executive Officer of the Company since September 2018. He previously served as Executive Vice President, General Counsel and Secretary from February 2016 to August 2018, and as Senior Vice President, General Counsel and Secretary from June 2009 to February 2016. Mr. Metz serves as chairman of our wholly owned subsidiary, Maiden Reinsurance Ltd. and is also a director of several of our wholly owned subsidiaries. From 2007 to 2009, Mr. Metz served as Vice President, General Counsel - US Operations and Assistant Secretary of AmTrust. From 2004 to 2007, Mr. Metz served as Vice President, General Counsel and Secretary of a publicly-traded provider of information management and business process optimization solutions. Mr. Metz holds a B.S. from the University of Wisconsin - Madison and a J.D. from Fordham University School of Law. Mr. Metz serves on the Board of Overseers of the RAND Institute for Civil Justice, and formerly served as the Chair and Vice Chair of the Legal Subcommittee of the Legal and Government Affairs Committee of the Property Casualty Insurers Association of America, and also formerly served on the Board of Advisors of the RAND Center for Corporate Ethics and Governance.

In selecting Mr. Metz as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Metz’s leadership role as the Company’s chief executive officer, his being a significant stakeholder developing and implementing the forward strategy and success of the Company, and his more than fifteen years of experience in executive management at public companies.

Raymond M. Neff, 75,77, has been a member of our Board of Directors since June 2007, and he currently serves as Chairman of the Audit Committee and as a member of the Compensation Committee and the Nominating and Corporate Governance Committee. He is also chairman of Sabal Palm Bank since 2007, chairman and CEO of Beacon Aviation Insurance Services since 2010, and on the board of directors of the not-for-profit Sarasota Gulf Coast CEO Forum. Since 1999, Mr. Neff has served as President of Neff & Associates, Inc. and Insurance Home Office Services, LLC. He previously worked at the FCCI Insurance Group from 1986 to 1999, most recently as President and Chief Executive Officer from 1987 to 1999. He was previously Chairman of the Board of the Florida Workers' Compensation Joint Underwriting Association. Mr. Neff has held various positions at the Department of Labor and Employment Security and the Department of Insurance for the State of Florida. Mr. Neff previously worked at an insurance consulting group, a multi-line insurance agency and the Department of Insurance for the State of Michigan. Mr. Neff has been chairman of Sabal Palm Bank since 2007, chairman and CEO of Beacon Aviation Insurance Services since 2010, and on the board of directors of the not-for-profit Sarasota Gulf Coast CEO Forum. Mr. Neff holds a B.S. in Mathematics and Accounting from Central Michigan University and an M.A. in Actuarial Science from the University of Michigan. Mr. Neff is a Member of the American Academy of Actuaries and an Associate of the Society of Actuaries.

In selecting Mr. Neff as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Neff's deep understanding of the insurance industry, as well as his business activities and significant executive and finance experience.

Yehuda L. Neuberger, 40,42, has been a member of our Board of Directors since January 2008. Mr. Neuberger is a private equity investor, investing across a broad spectrum of companies. Mr. Neuberger serves on the board of CUJO LLC, a global artificial intelligence company. Mr. Neuberger also serves in a leadership and board capacity with numerous, large not-for-profit organizations. Between December 2001 and December 2013, Mr. Neuberger held various senior leadership positions (including Executive Vice President and Director) at American Stock Transfer & Trust Company, LLC. Prior to joining American Stock Transfer, Mr. Neuberger practiced as an attorney with the law firm of Weil, Gotshal & Manges. Mr. Neuberger holds a B.S. from Johns Hopkins University and a J.D. from Harvard Law School. Mr. Neuberger is the son-in-law of George Karfunkel, who is a Founding Shareholder of the Company, as well as a major shareholder and a director of AmTrust.

In selecting Mr. Neuberger as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Neuberger's business activities and significant executive and finance knowledge. In addition, our Nominating and Corporate Governance Committee and Board of Directors values Mr. Neuberger's extensive experience as a lawyer and as a director of other companies.

Steven H. Nigro, 57,59, has been a member of our Board of Directors since July 2007, and as our Lead Independent Director since November 2016, our Vice Chairman since August 2018, and currently serves as Chairman of the Compensation Committee, a member of the Audit Committee, and the Nominating and Corporate Governance Committee. Mr. Nigro has over 3035 years of experience in financial services and specializes in mergers and acquisitions and capital raising for the insurance industry. In September 2012 Mr. Nigro became the Managing Partner of TAG Financial Institutions Group, LLC, an investment and merchant bank focusing on the financial services industry with specific concentration in the insurance industry. From 2011 to 2012 he was the Managing Director and Head of the Financial Services practice at Allegiance Capital Corporation. In 2005 Mr. Nigro co-founded Pfife Hudson Group, an investment bank specializing in the insurance industry and previously served as a Managing Director at Rhodes Financial Group, LLC and Hales & Company, both financial advisory firms catering exclusively to the insurance industry. From 1994 to 1998 he was Chief Financial Officer and Treasurer and a Director of Tower Group, Inc., an insurance holding company where he was responsible for financial and regulatory management, strategic planning and corporate finance. Mr. Nigro served as a Director of Clear Blue Financial Holdings, LLC from October 2015 through September 2016 and is currently a director of AEU Holdings, LLC.2016. Mr. Nigro began his career with Arthur Young and Co. and is a Certified Public Accountant in New York. Mr. Nigro graduated from the University at Albany with a major in Accounting and minor in Economics.

In selecting Mr. Nigro as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Nigro's extensive experience in the finance sector and his deep understanding of the insurance industry. Mr. Nigro's experience as a certified public accountant and an investment banker specializing in the insurance industry is valuable to our Nominating and Corporate Governance Committee and Board of Directors.

Keith A. Thomas, 61, has over 35 years of experience in capital markets, asset management and alternative investment sales. Since 2006, Mr. Thomas has served as a senior executive for marketing and business development at a number of institutional funds, including EIM Management (USA) Inc., a provider of hedge fund solutions for institutional investors, Muirfield Capital Management, a fund of hedge funds started by key executives from Donaldson, Lufkin & Jenrette Inc., and as an advisor to a number of emerging managers. Previously, Mr. Thomas served as Senior Vice President in derivative products departments at Smith Barney servicing institutional clients such as New York State Common Fund and the Inter-American Development Bank. Mr. Thomas graduated from Montclair State University with a B.A. in Marketing & Humanities. Mr. Thomas serves as a Trustee of The Lincoln Fund. He also was a founding board member of New York Cares and served as a trustee of the WNYC Radio Foundation for 25 years.

In selecting Mr. Thomas as a director nominee, our Nominating and Corporate Governance Committee and Board of Directors considered Mr. Thomas' significant experience in capital markets, financing, investments and marketing.

CORPORATE GOVERNANCE

Board Independence

Messrs. Lyons, Neff and Nigro are “independent directors” under the rules of the NASDAQ Global Select Market ("NASDAQ") and the New York Stock Exchange ("NYSE"). NASDAQ and the NYSE rules require that a majority of the Board of Directors be independent, and we are in compliance with this requirement. The independent directors held separate executive sessions without senior management on at least four occasions in 2016, and neither the chairman, chief executive officer (the "CEO") nor any member of management, at any level, attended any of the executive sessions of the independent directors.

Board Meetings and Committees; Attendance at Annual General Meeting

The Board of Directors held fournine meetings in 2016.2018. Each director attended at least 75% of the aggregate of the total number of meetings held in 20162018 of the Board and any committee on which he served. All directors are expected to make every effort to attend the 20172019 Annual General Meeting, and each director attended the 20162018 Annual General Meeting.

Board Committees

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each comprised entirely of independent directors within the meaning of the rules of the NASDAQ and NYSE.

Audit Committee

We have a separately-designated standing Audit Committee. The Audit Committee assists our Board of Directors in monitoring the integrity of our financial statements, the independent auditor's qualifications and independence, performance of our independent auditors and our internal audit function, the establishment and maintenance of proper internal accounting controls and procedures, the treatment of employees' concerns regarding accounting and auditing matters as reported to our whistleblower hotline, and our compliance with legal and regulatory requirements. The Audit Committee's responsibilities also include appointing (subject to shareholder ratification), reviewing, determining funding for and overseeing our independent auditors and their services. Further, the Audit Committee, to the extent it deems necessary or appropriate, among its several other responsibilities, shall:

review and approve all related party transactions, as well as any subsequent modifications thereto, for actual or potential conflict of interest situations on an ongoing basis;

review and discuss with appropriate members of our managementCapital Market ("NASDAQ") and the independent auditors our audited financial statements, related accountingNew York Stock Exchange ("NYSE").

Please see the section titled “Item 10. Directors, Executive Officers and auditing principles, practices and disclosures;

review and discuss our audited annual and unaudited quarterly financial statements prior to the filing of such statements;

establish procedures for the receipt, retention and treatment of complaints we receive regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding our financial statements or accounting policies;

review reports from the independent auditors on all critical accounting policies and practices to be used for our financial statements and discuss with the independent auditor the critical accounting policies and practices used in the financial statements;

assist the Enterprise Risk Management Committee in its responsibility for oversight of risk management, including cybersecurity;

obtain reports from our management and internal auditors that we and our subsidiaries are in compliance with the applicable legal requirements and our Code of Business Conduct and Ethics, and advise our Board of Directors about these matters; and

monitor the adequacy of our operating and internal controls as reported by management and the independent or internal auditors.

We have adopted a policy that requires that all related party transactions be approved by our Audit Committee. In response to an annual questionnaire, we require directors, director nominees and executive officers to submit a description of any current or proposed related party transaction and provides updates during the year. In addition, we will provide the Audit Committee any similar available information with respect to any known transactions with beneficial owners of 5% or more of our voting securities. If management becomes aware of any potential transactions during the year, management presents such transactions for approval by the Audit Committee. In the event management becomes aware of any transaction that was not approved under the policy, management will present the transaction to the Audit Committee for its action as soon as reasonably practicable, which may include termination, amendment or ratification of the transaction. The Audit Committee will approve only those transactions that are in, or are not inconsistent with, the best interests of Maiden and our shareholders, as is determined in good faith in accordance with its business judgment. Unless otherwise indicated below, each of these related party transactions was approved by our Audit Committee.

Mr. Neff is the chairman of our Audit Committee and the other members are Messrs. Lyons and Nigro. All the members of the Audit Committee are independent both under SEC rules and as that term is defined in the listing standards of NASDAQ and NYSE. The Board of Directors has determined that Messrs. Lyons, Neff and Nigro are “audit committee financial experts.Corporate Governance”

The Audit Committee has adopted a charter, which is currently available on our website at www.maiden.bm. Information on our website is not incorporated by reference into this report and does not otherwise form a part of this report.

During 2016, the Audit Committee met five times.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed and discussed the audited consolidated financial statements of Maiden Holdings, Ltd. with management and the independent auditors for the year ended December 31, 2016. The Audit Committee has discussed with the independent auditors the matters required to be discussed by the Statement on Auditing Standards No. 1301, as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

The Audit Committee has received the written disclosures and the letter from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board in Rule 3526 regarding the independent auditors' communications with the Audit Committee concerning independence. The Audit Committee has discussed with the independent auditors the independent auditors' independence. The independent auditors and the Company's internal auditors had full access to the Audit Committee, including meetings without management present as needed.

Based on the Audit Committee’s review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the Company's audited consolidated financial statements be included in our Annual Report on Form 10-K10-K/A for the fiscal year ended December 31, 20162018, filed with the SEC on March 6, 2017.

Raymond M. Neff, Chairman

Simcha G. Lyons

Steven H. Nigro

Compensation Committee

The Compensation Committee’s responsibilities include, among other responsibilities:

reviewing and approvingApril 30, 2019, for more information about the Company’s corporate and individual goals and objectives relevant to the compensation of our Chief Executive Officer and other named executive officers;

evaluating the performance of our Chief Executive Officer and other executive officers in light of such corporate and individual goals and objectives and, based on that evaluation, together with the other independent directors if directed by the Board of Directors, determining the base salary and bonus of the Chief Executive Officer and other executive officers and reviewing the same on an ongoing basis;

reviewing all related party transactions involving compensatory matters;

establishing and administering equity-based compensation under the Amended and Restated 2007 Share Incentive Plan (the “Plan”) and any other incentive plans and approving all grants made pursuant to such plans; and

making recommendations to our Board of Directors regarding non-employee director compensation and any equity-based compensation plans.

Please refer to the Compensation Discussion and Analysis within this Proxy Statement for additional discussion of our policies and procedures for determining and establishing executive compensation.governance.

Mr. Nigro is the chairman of our Compensation Committee and the other members of our Compensation Committee are Messrs. Neff and Lyons. All the members of the Compensation Committee are independent both under SEC rules and as that term is defined in the listing standards of NASDAQ and NYSE.

The Compensation Committee has adopted a charter. The charter is currently available on our website at www.maiden.bm. Information on our website is not incorporated by reference into this report and does not otherwise form a part of this report.

The Compensation Committee's independent compensation consultant is Mercer (U.S.) Inc. ("Mercer"). Mercer is engaged by, and reports directly to, the Compensation Committee, which has the sole authority to hire or fire Mercer and to approve fee arrangements for work performed. Mercer assists the Compensation Committee in fulfilling its responsibilities under its charter, including advising on proposed compensation packages for executive officers, compensation program design and market practices generally. The Compensation Committee has authorized Mercer to interact with management on behalf of the Compensation Committee, as needed in connection with advising the Compensation Committee. It is the Compensation Committee's policy that the Chairman of the Compensation Committee or the full Compensation Committee pre-approve any additional services provided to management by our independent compensation consultant. In fiscal year 2016, Mercer only did work for the Compensation Committee or its senior management designee. The Compensation Committee has assessed the independence of Mercer pursuant to SEC rules and concluded that Mercer's work for the Compensation Committee does not raise any conflict of interest.

During 2016, the Compensation Committee met three times.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s responsibilities with respect to assisting our Board of Directors include, among other responsibilities:

establishing the criteria for membership on our Board of Directors and certain subsidiaries;

reviewing periodically the structure, size and composition of our Board of Directors and making recommendations to the board as to any necessary adjustments;

identifying individuals qualified to become directors for recommendation to our Board of Directors;

identifying and recommending for appointment to our Board of Directors, directors qualified to fill vacancies on any committee of our Board of Directors;

having sole authority to select, retain and terminate any consultant or search firm to identify director candidates and having sole authority to approve the consultant or search firm’s fees and other retention terms;

considering matters of corporate governance, developing and recommending to the board a set of corporate governance principles and our Code of Business Conduct and Ethics, as well as recommending to the board any modifications thereto;

considering questions of actual or possible conflicts of interest, including related party transactions, of members of our Board of Directors and of senior executives of our Company;

developing and recommending to our Board of Directors for its approval an annual board and committee self-evaluation process to determine the effectiveness of their functioning; and

exercising oversight of the evaluation of the board, its committees and management.

Mr. Lyons is the chairman of our Nominating and Corporate Governance Committee and the other members are Messrs. Neff and Nigro. All the members of the Nominating and Corporate Governance Committee are independent both under SEC rules and as that term is defined in the listing standards of NASDAQ and NYSE.

In carrying out its function to nominate candidates for election to our Board of Directors, the Nominating and Corporate Governance Committee considers the mix of skills, experience, character, commitment, and diversity of background, all in the context of the requirements of our Board of Directors at that point in time. The Nominating and Corporate Governance Committee interprets diversity to include viewpoints, background, expertise, industry knowledge and geography, as well as more traditional characteristics of diversity, such as race and gender. We believe that the commitment of the Board and the Committee to greater diversity in its governing committees is demonstrated by the current structure of the Board and the varied skills sets of our directors. The Nominating and Corporate Governance Committee believes that each candidate should be an individual who has demonstrated integrity and ethics in such candidate's personal and professional life, has an understanding of elements relevant to the success of a publicly-traded company and has established a record of professional accomplishment in such candidate's chosen field. Each candidate should be prepared to participate fully in Board of Directors activities, including attendance at, and active participation in, meetings of the Board of Directors, and not have other personal or professional commitments that would, in the Nominating and Corporate Governance Committee's judgment, interfere with or limit such candidate's ability to do so. Each candidate should also be prepared to represent the best interests of all of our shareholders and not just one particular constituency. Additionally, in determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee also considers the director's past attendance at Board of Directors and committee meetings and participation in and contributions to the activities of our Board of Directors.

The Nominating and Corporate Governance Committee considers recommendations for director candidates submitted by shareholders. In order for an individual recommended by a shareholder to be eligible for election as a director and considered by the Nominating and Corporate Governance Committee for the 2018 Annual General Meeting of Shareholders, the Corporate Secretary must receive the shareholder's recommendation not earlier than January 2, 2018, nor later than February 1, 2018, as required by our bye-laws.

A shareholder recommending an individual for election as a director must provide the Nominating and Corporate Governance Committee with the candidate's name, age, principal occupation or employment, background and relationship with the proposing shareholder, share ownership, a brief statement outlining the reasons the candidate would be an effective director and information relevant to the considerations described above. Shareholders should send the required information to the Corporate Secretary, Maiden House, 131 Front Street, Hamilton HM12, Bermuda. The Nominating and Corporate Governance Committee may require further information. Such recommendations must be sent via registered, certified or express mail (or other means that allow the shareholder to determine when the recommendation was received by us). The Corporate Secretary will send any shareholder recommendations to the Nominating and Corporate Governance Committee for consideration at a future committee meeting. Individuals recommended by shareholders in accordance with these procedures will receive the same consideration as other individuals evaluated by the Nominating and Corporate Governance Committee.

On February 21, 2017, the Nominating and Corporate Governance Committee agreed to recommend the present five directors for re-nomination to the Board as well as to maintain the present composition of the various committees of the Board.

The Nominating and Corporate Governance Committee has adopted a charter. The charter is currently available on our website at www.maiden.bm. Information on our website is not incorporated by reference into this report and does not otherwise form a part of this report.

During 2016, the Nominating and Corporate Governance Committee met three times.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

We have adopted corporate governance guidelines and a code of business conduct and ethics that apply to all of our directors, officers and employees. These documents will be made available in print, free of charge, to any shareholder requesting a copy in writing to the Corporate Secretary, Maiden Holdings, Ltd., Maiden House, 131 Front Street, Hamilton HM12 Bermuda. A copy of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics is available on our website at www.maiden.bm. Information on our website is not incorporated by reference into this report and does not otherwise form a part of this report.

Communications with the Board of Directors and Audit Committee

Shareholders and other interested parties may communicate with members of the Board of Directors (either individually or as a body) by addressing the correspondence to that individual or body to The Board of Directors, c/o Chief Financial Officer, Maiden Holdings, Ltd., Maiden House, 131 Front Street, Hamilton HM12, Bermuda or by calling (441) 298-4900.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires officers, directors and persons who own more than ten (10) percent of a class of equity securities registered pursuant to Section 12 of the Exchange Act to file reports of ownership and changes in ownership with both the SEC and the principal exchange upon which such securities are traded or quoted. Officers, directors and persons holding greater than ten (10) percent of the outstanding shares of a class of Section 12-registered equity securities (“Reporting Persons”) are also required to furnish copies of any such reports filed pursuant to Section 16(a) of the Exchange Act with the Company. Based solely on a review of the copies of such forms furnished to the Company and written representations that no other reports were required, the Company believes that from January 1, 2016 to December 31, 2016 all but one Section 16(a) filing requirements applicable to its Reporting Persons were complied with in a timely manner.

Risk Management Oversight

The Board of Directors has the ultimate oversight responsibility for the risk management function of the Company. The Company has implemented an enterprise-wide approach to risk management and has established an Enterprise Risk Management Committee (the “ERMC”) which consists of members of the Company's executive management. The members of the ERMC include senior executives, including our Chief Executive Officer, Chief Financial Officer, presidents of our major subsidiaries, Chief Actuary, and General Counsel. It also includes senior executives from our other main operating subsidiaries in Bermuda, the United States and Europe. The ERMC oversees the Company's framework for the identification, assessment, measurement, and reporting of and management of exposure to the Company's risk on an enterprise-wide basis. Our Audit Committee receives a quarterly enterprise risk management overview from executive management, which includes updates on areas including operational/strategic risk, financial risk, legal/compliance risk, and emerging risks.

The Audit Committee assists the ERMC in its responsibility for oversight of risk management. In particular, the Audit Committee focuses on major financial risk exposures and the steps management has taken to monitor and control such risks, and discusses with our independent auditor the policies governing the process by which senior management and the various units of the Company assess and manage our financial risk exposure and operational/strategic risk.

The Company has separated the positions of Chief Executive Officer and Chairman of the Board. This separation enhances Board administration and communication, allows for consistent Board leadership and allows the Chief Executive Officer to focus on managing the Company.

Risks Related to Compensation Practices and Policies

Our Compensation Committee has reviewed our material compensation policies and practices applicable to our employees, including our named executive officers, and concluded that these policies and practices do not create risks that are reasonably likely to have a material adverse effect on us. Our Compensation Committee assessed the Company's compensation and benefits programs to determine if the programs' provisions and operations create undesired or unintentional risk of a material nature. We do not have any programs where the ability of a participant may directly affect variability of payout. Rather, we support the use of base salary, performance based compensation, and retirement plans that are generally uniform in design and operation throughout the Company and with all levels of employees.

Based on the foregoing, we believe that our compensation policies and practices do not create inappropriate or unintended significant risk to the Company as a whole. We also believe that our incentive compensation arrangements provide incentives that do not encourage risk-taking beyond our Company's ability to effectively identify and manage significant risks, are compatible with our effective internal controls and our risk management practices, and are supported by the oversight and administration of the Compensation Committee with regard to executive compensation programs.

EXECUTIVE OFFICERS

The table below sets forth the names, ages and positions of our executive officers as of the date of this Proxy Statement:

|

| | | | |

| Name | | Age | | Position(s) |

Arturo M. RaschbaumLawrence F. Metz | | 6146 | | President and Chief Executive Officer |

Karen L. SchmittPatrick J. Haveron | | 58 | | Executive Vice President, and Chief Financial Officer and Chief Operating Officer |

Patrick J. HaveronWilliam T. Jarman | | 5545 | | ExecutiveSenior Vice President, and President of Maiden Reinsurance Ltd.Chief Actuary |

Thomas H. HighetDenis M. Butkovic | | 5746 | | President of Maiden Reinsurance North America, Inc. |

Lawrence F. Metz | | 44 | | ExecutiveSenior Vice President, General Counsel and Secretary |

| Michael C. Haines | | 63 | | Senior Vice President, Finance |

Set forth below are descriptions of the backgrounds of each of our executive officers.

Arturo M. Raschbaum, President and Chief Executive Officer, has served in that role since November 2008. Mr. Raschbaum is also a director of several of our other wholly owned subsidiaries. From 1994 to 2008, Mr. Raschbaum held several leadership positions with GMAC Insurance Holdings, including President of GMAC Insurance and president of GMAC RE and its predecessors. Mr. Raschbaum holds a B.B.A. from the University of Texas at El Paso and attended the Stanford University Executive Program. Mr. Raschbaum serves on the board of governors of the Property Casualty Insurers Association of America, and also serves on the Board of Advisors of the RAND Institute for Civil Justice.

Karen L. Schmitt, Executive Vice President and Chief Financial Officer, has served in those roles since May 2014, and previously served as President of Maiden Reinsurance North America, Inc. and Maiden Specialty Insurance Company from 2009 to 2014. Ms. Schmitt is also a director of several of our wholly owned subsidiaries. From 1999 to 2008, Ms. Schmitt served in various capacities at GMAC RE, including most recently as Chief Operating Officer. Prior to 1999, Ms. Schmitt held positions as Chief Actuary and Senior Vice President at TIG Holdings, Vice President of American Reinsurance, and various positions at Prudential Property and Casualty. Ms. Schmitt holds an M.B.A from the Wharton School of the University of Pennsylvania and a B.S. in Actuarial Science from Lebanon Valley College. She is a Fellow of both the Casualty Actuarial Society (FCAS) and the Canadian Institute of Actuaries (FCIA), a Member of the American Academy of Actuaries (MAAA), a Chartered Enterprise Risk Analyst (CERA), and a Chartered Financial Consultant (ChFC).

Patrick J. Haveron, Executive Vice President, has served in that role since November 2009, and as President of Maiden Reinsurance since February 2014. Mr. Haveron is also a director of several of our wholly owned subsidiaries. From 2004 to 2009, Mr. Haveron was President and Chief Executive Officer of Preserver Group, Inc., a publicly-traded property and casualty insurer, after having served in a variety of financial and executive leadership roles since 1988. Mr. Haveron was also Senior Vice President and Chief Operating Officer of Tower Group, Inc., a publicly-traded property and casualty insurer, from 2007 to 2009 after its acquisition of Preserver in 2007. Mr. Haveron has previously served on the board of governors of the Property Casualty Insurers Association of America, and holds a B.S. from the University of Scranton.

Thomas H. Highet, President of Maiden Reinsurance North America, Inc. ("MRNA"), has served in that role since May 2014 and previously served as its Executive Vice President. Mr. Highet, director of MRNA since 2008, is also a director of several of our wholly owned U.S. subsidiaries. Mr. Highet, who joined Maiden Re Insurance Services, LLC (formerly GMAC RE) in 1988, has over 30 years of reinsurance experience. He previously held positions with PMA Re, Metropolitan Re and AFIA. Mr. Highet graduated from Stevens Institute of Technology with a Bachelor of Science. He is an Associate of the Casualty Actuarial Society and a Member of the American Academy of Actuaries.

Lawrence F. Metz, Executive Vice President, General Counsel and Secretary, has served in that role since June 2009 (Mr. Metz was promoted from Senior Vice President to Executive Vice President in February 2016). Mr. Metz is also a director and secretary of several of our wholly owned subsidiaries. From 2007 to 2009, Mr. Metz served as Vice President, General Counsel - US Operations and Assistant Secretary of AmTrust. From 2004 to 2007, Mr. Metz served as Vice President, General Counsel and Secretary of a publicly-traded provider of information management and business process optimization solutions. Mr. Metz holds a B.S. from the University of Wisconsin - Madison and a J.D. from Fordham University School of Law, and is a member of the Bar of the Supreme Court of the United States, the New Jersey State Bar Association and the New York State Bar Association. Mr. Metz serves as the Vice Chair of the Legal Subcommittee of the Legal and Government Affairs Committee of the Property Casualty Insurers Association of America, and also serves on the Board of Advisors of the RAND Center for Corporate Ethics and Governance.

COMPENSATION DISCUSSION AND ANALYSIS

The material elements of our compensation philosophy, strategy and plans are discussed below. The Compensation Committee is responsible for establishing, implementing and monitoring our compensation programs, philosophy and objectives.

Overview

The objectives of our executive compensation policy will be to retain those executives whom we believe will be essential to our growth, to attract other talented and dedicated executives and to motivate each of our executives to develop our overall profitability. To achieve these goals, we intend to offer each executive an overall compensation package that is competitive, and a substantial portion of which will be tied to the achievement of specific performance objectives. Our overall strategy is to compensate our named executive officers with a mix of cash compensation,in detail in the form of base salary and bonus, and equity compensation,section titled "Item. 11. Executive Compensation" in the form of share options, restricted share and restricted share unit awards.

The Company, and separately the Compensation Committee, utilized industry competitive executive compensation data provided by our compensation consultant, Mercer, and the reinsurance industry surveys of Towers Watson Data Services, Property and Casualty Reinsurance Compensation Survey and the PWC Bermuda International Business Compensation SurveyAnnual Report on Form 10-K/A for the Insurance and Reinsurance Industry to analyze the competitive compensation elements of base salary, long term and annual incentives, total direct compensation and Bermuda benefits for our named executive officers and other company executives. Mr. Raschbaum is involved in making recommendations to the Compensation Committee regarding the compensation arrangements for other executives. The above factors all directly assisted the Compensation Committee to determine fair compensation for the CEO and the other named executive officers.

We have entered into employment agreements with each of our named executive officers.

Executive Compensation

We believe that the Company's compensation packages provide a reasonable arrangement of pay elements that align executive incentivesfiscal year ended December 31, 2018, filed with the creation of shareholder value, and bonuses and share-based awards that are dependentSEC on and strictly tied to, the Company's performance and paid upon the achievement of business goals and key business metrics. Our executive compensation policy includes the following fixed and variable elements:

Fixed Compensation

Salary.April 30, 2019. The base salaries provided to our named executive officers are designed to deliver an annual salary at a level consistent with individual experience, skills and contributions to the Company, and are consistent with levels paid by direct and indirect competitors in the reinsurance marketplace. The Compensation Committee generally establishes executive officer base salaries at base compensation levels consistent with benchmark compensation levels for executives with similar job responsibilities at select peer group companies as reported by independent compensation surveys. The annual base salary ofdisclosure regarding each of the named executive officers is set in each of their employment agreements and is reviewed on an annual basis. The Compensation Committee determines the CEO's compensation after consultation with each director on the Board of Directors as well as the Company's outside compensation consultant, and reviews the recommendations of the CEO concerning the compensation of the other named executive officers and makes determinations with respect thereto. In February 2017, the Compensation Committee chose to maintain the base salary of each of the named executive officers.

Benefits. The Company seeks to provide benefit plans, such as health and welfare programs to provide life insurance, 401(k), health and disability benefits to our employees, in line with applicable market conditions. These health and welfare plans help ensure that the Company has a productive and focused workforce through reliable and competitive health and other benefits. The named executive officers are eligible for the same benefit plans provided to all other employees local to the entity in which they operate.